User:Penn Station/draft

xxx(英: Subprime mortgage crisis)

en:Template:Financial crisis The subprime mortgage crisis is an ongoing financial crisis triggered by a dramatic rise in mortgage delinquencies and foreclosures in the United States, with major adverse consequences for banks and financial markets around the globe. The crisis, which has its roots in the closing years of the 20th century, became apparent in 2007 and has exposed pervasive weaknesses in financial industry regulation and the global financial system.

Many U.S. mortgages issued in recent years were made to subprime borrowers, defined as those with lesser ability to repay the loan based on various criteria. When U.S. house prices began to decline in 2006-07, mortgage delinquencies soared, and securities backed with subprime mortgages, widely held by financial firms, lost most of their value. The result has been a large decline in the capital of many banks and USA government sponsored enterprises, tightening credit around the world.

Background

[edit]

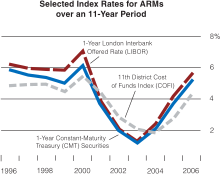

The crisis began with the bursting of the United States housing bubble[1][2] and high default rates on "subprime" and adjustable-rate mortgages (ARM), beginning in approximately 2005–2006. Government policies and competitive pressures for several years prior to the crisis encouraged higher risk lending practices.[3][4] Further, an increase in loan incentives such as easy initial terms and a long-term trend of rising housing appreciation had encouraged borrowers to assume difficult mortgages in the belief they would be able to quickly refinance at less costly terms. However, once interest rates began to rise and housing prices started to drop moderately in 2006–2007 in many parts of the U.S., borrowers were unable to refinance. Defaults and home foreclosure activity increased dramatically as easy initial terms expired, home prices failed to go up as anticipated, and ARM interest rates reset higher. Foreclosures accelerated in the United States in late 2006 and triggered a global financial crisis through 2007 and 2008. During 2007, nearly 1.3 million U.S. housing properties were subject to foreclosure activity, an increase of nearly 79% from 2006.[5]

Financial products called mortgage-backed securities (MBS), which derive their value from mortgage payments and housing prices, had enabled financial institutions and investors around the world to invest in the U.S. housing market. Major banks and financial institutions had borrowed and invested heavily in MBS and reported losses of approximately US$435 billion as of 17 July 2008.[6][7] The liquidity and solvency concerns regarding key financial institutions drove central banks to take action to provide funds to banks to encourage lending to worthy borrowers and to restore faith in the commercial paper markets, which are integral to funding business operations. Governments also bailed out key financial institutions, assuming significant additional financial commitments.

The risks to the broader economy created by the housing market downturn and subsequent financial market crisis were primary factors in several decisions by central banks around the world to cut interest rates and governments to implement economic stimulus packages. These actions were designed to stimulate economic growth and inspire confidence in the financial markets. Effects on global stock markets due to the crisis have been dramatic. Between 1 January and 11 October 2008, owners of stocks in U.S. corporations had suffered about $8 trillion in losses, as their holdings declined in value from $20 trillion to $12 trillion. Losses in other countries have averaged about 40%.[8] Losses in the stock markets and housing value declines place further downward pressure on consumer spending, a key economic engine.[9] Leaders of the larger developed and emerging nations met in November 2008 to formulate strategies for addressing the crisis.[10]

Mortgage market

[edit]

Subprime lending is the practice of lending, mainly in the form of mortgages for the purchase of residences, to borrowers who do not meet the usual criteria for borrowing at the lowest prevailing market interest rate. These criteria pertain to the borrower's credit score, credit history and other factors. If a borrower is delinquent in making timely mortgage payments to the loan servicer (a bank or other financial firm), the lender can take possession of the residence acquired using the proceeds from the mortgage, in a process called foreclosure.

The value of USA subprime mortgages was estimated at $1.3 trillion as of March 2007, [11] with over 7.5 million first-lien subprime mortgages outstanding.[12] Between 2004-2006 the share of subprime mortgages relative to total originations ranged from 18%-21%, versus less than 10% in 2001-2003 and during 2007.[13][14] In the third quarter of 2007, subprime ARMs making up only 6.8% of USA mortgages outstanding also accounted for 43% of the foreclosures which began during that quarter.[15] By October 2007, approximately 16% of subprime adjustable-rate mortgages (ARM) were either 90-days delinquent or the lender had begun foreclosure proceedings, roughly triple the rate of 2005.[16] By January 2008, the delinquency rate had risen to 21%.[17] and by May 2008 it was 25%.[18]

The value of all outstanding residential mortgages, owed by USA households to purchase residences housing at most four families, was US$9.9 trillion as of year-end 2006, and US$10.6 trillion as of midyear 2008.[19] During 2007, lenders had begun foreclosure proceedings on nearly 1.3 million properties, a 79% increase over 2006.[20] This increased to 2.3 million in 2008, an 81% increase vs. 2007.[21] As of August 2008, 9.2% of all mortgages outstanding were either delinquent or in foreclosure.[22] Between August 2007 and October 2008, 936,439 USA residences completed foreclosure.[23] Foreclosures are concentrated in particular states both in terms of the number and rate of foreclosure filings.[24] Ten states accounted for 74% of the foreclosure filings during 2008; the top two (California and Florida) represented 41%. Nine states were above the national foreclosure rate average of 1.84% of households.[25]

Credit risk

[edit]

Credit risk arises because a borrower has the option of defaulting on the loan he/she owes. Traditionally, lenders (who were primarily thrifts) bore the credit risk on the mortgages they issued. Over the past 60 years, a variety of financial innovations have gradually made it possible for lenders to sell the right to receive the payments on the mortgages they issue, through a process called securitization. The resulting securities are called mortgage backed securities (MBS) and collateralized debt obligations (CDO). Most American mortgages are now held by mortgage pools, the generic term for MBS and CDOs. Of the $10.6 trillion of USA residential mortgages outstanding as of midyear 2008, $6.6 trillion were held by mortgage pools, and $3.4 trillion by traditional depository institutions. [26]

This "originate to distribute" model means that investors holding MBS and CDOs also bear several types of risks, and this has a variety of consequences. In general, there are five primary types of risk:[27][28]

| Name | Description |

|---|---|

| Credit risk | the risk that the homeowner or borrower will be unable or unwilling to pay back the loan |

| Asset price risk | the risk that assets (MBS in this case) will depreciate in value, resulting in financial losses, markdowns and possibly margin calls |

| Liquidity risk | the risk that a business entity will be unable to obtain financing, such as from the commercial paper market |

| Counterparty risk | the risk that a party to a contract will be unable or unwilling to uphold their obligations. |

| Systemic risk | The aggregate effect of these and other risks has recently been called systemic risk, which refers to when formerly uncorrelated risks shift and become highly correlated, damaging the entire financial system |

When homeowners default, the payments received by MBS and CDO investors decline and the perceived credit risk rises. This has had a significant adverse effect on investors and the entire mortgage industry. The effect is magnified by the high debt levels (financial leverage) households and businesses have incurred in recent years. Finally, the risks associated with American mortgage lending have global impacts, because a major consequence of MBS and CDOs is a closer integration of the USA housing and mortgage markets with global financial markets.

Investors in MBS and CDOs can insure against credit risk by buying credit defaults swaps (CDS). As mortgage defaults rose, the likelihood that the issuers of CDS would have to pay their counterparties increased. This created uncertainty across the system, as investors wondered if CDS issuers would honor their commitments.

Causes

[edit]The reasons proposed for this crisis are varied and complex. The crisis can be attributed to a number of factors pervasive in both housing and credit markets, factors which emerged over a number of years. Causes proposed include the inability of homeowners to make their mortgage payments, due primarily to adjusted rate mortgages resetting, borrowers overextending, predatory lending, speculation and overbuilding during the boom period, risky mortgage products, high personal and corporate debt levels, financial products that distributed and perhaps concealed the risk of mortgage default, monetary policy, international trade imbalances, and government regulation (or the lack thereof).[30][31] Two important catalysts of the subprime crisis were the influx of moneys from the private sector and banks entering into the mortgage bond market and the predatory lending practices of mortgage brokers, specifically the adjusted rate mortgage, 2-28 loan.[32][33] Utimately, though, moral hazard lay at the core of many of the causes.[34]

In its "Declaration of the Summit on Financial Markets and the World Economy," dated 15 November 2008, leaders of the Group of 20 cited the following causes:

Boom and bust in the housing market

[edit]

Low interest rates and large inflows of foreign funds created easy credit conditions for a number of years prior to the crisis, fueling a housing market boom and encouraging debt-financed consumption.[35] The USA home ownership rate increased from 64% in 1994 (about where it had been since 1980) to an all-time high of 69.2% in 2004.[36] Subprime lending was a major contributor to this increase in home ownership rates and in the overall demand for housing, which drove prices higher.

Between 1997 and 2006, the price of the typical American house increased by 124%.[37] During the two decades ending in 2001, the national median home price ranged from 2.9 to 3.1 times median household income. This ratio rose to 4.0 in 2004, and 4.6 in 2006.[38] This housing bubble resulted in quite a few homeowners to refinance their homes at lower interest rates, or finance consumer spending by taking out second mortgages secured by the price appreciation. USA household debt as a percentage of annual disposable personal income was 127% at the end of 2007, versus 77% in 1990.[39]

While housing prices were increasing, consumers were saving less[40] and both borrowing and spending more. A culture of consumerism is a factor "in an economy based on immediate gratification."[41] Starting in 2005, American households have spent more than 99.5% of their disposable personal income on consumption or interest payments.[42] If imputations mostly pertaining to owner-occupied housing are removed from these calculations, American households have spent more than their disposable personal income in every year starting in 1999.[43] Household debt grew from $705 billion at year-end 1974, 60% of disposable personal income, to $7.4 trillion at year end 2000, and finally to $14.5 trillion in midyear 2008, 134% of disposable personal income.[44] During 2008, the typical USA household owned 13 credit cards, with 40% of households carrying a balance, up from 6% in 1970.[45]

This credit and house price explosion led to a building boom and eventually to a surplus of unsold homes, which caused U.S. housing prices to peak and begin declining in mid-2006.[46] Easy credit, and a belief that house prices would continue to appreciate, had encouraged many subprime borrowers to obtain risky mortgages adjustable-rate mortgages. These mortgages enticed borrowers with a below market interest rate for some predetermined period, followed by market interest rates for the remainder of the mortgage's term. Borrowers who could not make the higher payments once the initial grace period ended would try to refinance their mortgages. Borrowers of these mortgages were unable to refinance once house prices began to decline in many parts of the USA. Borrowers who found themselves unable to escape higher monthly payments began to default.

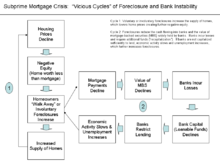

As more borrowers stoped paying their mortgage payments, foreclosures and the supply of homes for sale increased. This places downward pressure on housing prices, which further lowers homeowners' equity equity. The decline in mortgage payments also reduces the value of mortgage-backed securities, which erodes the net worth and financial health of banks. This vicious cycle is at the heart of the crisis.[47]

By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak.[48][49] This major and unexpected decline in house prices means that many borrowers have zero or negative equity in their homes, meaning their homes were worth less than their mortgages. As of March 2008, an estimated 8.8 million borrowers — 10.8% of all homeowners — had negative equity in their homes, a number that is believed to have risen to 12 million by November 2008. Borrowers in this situation have an incentive to "walk away" from their mortgages and abandon their homes, even though doing so will damage their credit rating for a number of years.[50]

Increasing foreclosure rates increases the inventory of houses offered for sale. The number of new homes sold in 2007 was 26.4% less than in the preceding year. By January 2008, the inventory of unsold new homes was 9.8 times the December 2007 sales volume, the highest value of this ratio since 1981.[51] Furthermore, nearly four million existing homes were for sale,[52] of which almost 2.9 million were vacant.[53] This overhang of unsold homes lowered house prices. As prices declined, more homeowners were at risk of default or foreclosure. House prices are expected to continue declining until this inventory of unsold homes (an instance of excess supply) declines to normal levels.[54]

Economist Nouriel Roubini wrote in January 2009 that subprime mortgage defaults triggered the broader global credit crisis, but were just one symptom of multiple debt bubble collapses: "This crisis is not merely the result of the U.S. housing bubble’s bursting or the collapse of the United States’ subprime mortgage sector. The credit excesses that created this disaster were global. There were many bubbles, and they extended beyond housing in many countries to commercial real estate mortgages and loans, to credit cards, auto loans, and student loans. There were bubbles for the securitized products that converted these loans and mortgages into complex, toxic, and destructive financial instruments. And there were still more bubbles for local government borrowing, leveraged buyouts, hedge funds, commercial and industrial loans, corporate bonds, commodities, and credit-default swaps..." It is the bursting of the many bubbles that he believes are causing this crisis to spread globally and magnify its impact.[55]

Speculation

[edit]Speculation in residential real estate has been a contributing factor. During 2006, 22% of homes purchased (1.65 million units) were for investment purposes, with an additional 14% (1.07 million units) purchased as vacation homes. During 2005, these figures were 28% and 12%, respectively. In other words, a record level of nearly 40% of homes purchases were not intended as primary residences. David Lereah, NAR's chief economist at the time, stated that the 2006 decline in investment buying was expected: "Speculators left the market in 2006, which caused investment sales to fall much faster than the primary market."[56]

Housing prices nearly doubled between 2000 and 2006, a vastly different trend from the historical appreciation at roughly the rate of inflation. While homes had not traditionally been treated as investments subject to speculation, this behavior changed during the housing boom. For example, one company estimated that as many as 85% of condominium properties purchased in Miami were for investment purposes. Media widely reported condominiums being purchased while under construction, then being "flipped" (sold) for a profit without the seller ever having lived in them.[57] Some mortgage companies identified risks inherent in this activity as early as 2005, after identifying investors assuming highly leveraged positions in multiple properties.[58]

Nicole Gelinas of the Manhattan Institute described the consequences of failing to respond to the shifting treatment of a home from conservative inflation hedge to speculative investment. For example, individuals investing in equities have margin (borrowing) restrictions and receive warnings regarding the risk to principal; there are no such requirements for home buyers. While stock brokers are prohibited from telling an investor that a stock or bond investment cannot lose money, it was not illegal for mortgage brokers to do so. Equity investors are well-aware of the need to diversify their financial holdings, but for many homeowners the home represented both a leveraged and concentrated risk. Further, in the U.S. capital gains on stocks are taxed more aggressively than housing appreciation, which has large exemptions. These factors all enabled speculative behavior.[59]

Economist Robert Shiller argues that speculative bubbles are fueled by "contagious optimism, seemingly impervious to facts, that often takes hold when prices are rising. Bubbles are primarily social phenomena; until we understand and address the psychology that fuels them, they're going to keep forming."[60] Keynesian economist Hyman Minsky described three types of speculative borrowing that contribute to rising debt and an eventual collapse of asset values:[61][62]

- The "hedge borrower," who expects to make debt payments from cash flows from other investments;

- The "speculative borrower," who borrows believing that he can service the interest on his loan, but who must continually roll over the principal into new investments;

- The "Ponzi borrower," who relies on the appreciation of the value of his assets to refinance or pay off his debt, while being unable to repay the original loan.

Speculative borrowing has been cited as a contributing factor to the subprime mortgage crisis.[63]

High-risk mortgage loans and lending/borrowing practices

[edit]Lenders began to offer more and more loans to higher-risk borrowers,[64] including illegal immigrants.[65] Subprime mortgages amounted to $35 billion (5% of total originations) in 1994,[66] 9% in 1996,[67] $160 billion (13%) in 1999,[66] and $600 billion (20%) in 2006.[67][68][69] A study by the Federal Reserve found that the average difference between subprime and prime mortgage interest rates (the "subprime markup") declined from 280 basis points in 2001, to 130 basis points in 2007. In other words, the risk premium required by lenders to offer a subprime loan declined. This occurred even though the credit ratings of subprime borrowers, and the characteristics of subprime loans, both declined during the 2001–2006 period, which should have had the opposite effect. The combination of declining risk premia and credit standards is common to classic boom and bust credit cycles.[70]

In addition to considering higher-risk borrowers, lenders have offered increasingly risky loan options and borrowing incentives. In 2005, the median down payment for first-time home buyers was 2%, with 43% of those buyers making no down payment whatsoever.[71] By comparison, China has down payment requirements that exceed 20%, with higher amounts for non-primary residences.[72]

One high-risk option was the "No Income, No Job and no Assets" loans, sometimes referred to as Ninja loans. Another example is the interest-only adjustable-rate mortgage (ARM), which allows the homeowner to pay just the interest (not principal) during an initial period. Still another is a "payment option" loan, in which the homeowner can pay a variable amount, but any interest not paid is added to the principal. An estimated one-third of ARMs originated between 2004 and 2006 had "teaser" rates below 4%, which then increased significantly after some initial period, as much as doubling the monthly payment.[73]

The proportion of subprime ARM loans made to people with credit scores high enough to qualify for conventional mortgages with better terms increased from 41% in 2000 to 61% by 2006. However, there are many factors other than credit score that affect lending. In addition, mortgage brokers in some cases received incentives from lenders to offer subprime ARM's even to those with credit ratings that merited a conforming (i.e., non-subprime) loan. For example, brokers for one lender could earn a "yield spread premium" equal to 2% of the loan amount -- or $8,000 on a $400,000 loan -- if a borrower's interest rate was an extra 1.25 percentage points higher than the lender's prime rates. On average, U.S. mortgage brokers collected 1.88% of the loan amount for originating a subprime loan, compared with 1.48% for conforming loans. Payouts for subprime loans have traditionally been higher, in part because these loans sometimes took more work and the approval rate could be lower. However, critics claim that yield-spread premiums encourage brokers to steer borrowers into loans that cost far more than they should and create excessive financial risk. In October 2007, the Massachusetts Attorney General filed a related lawsuit. However, a provision outlawing incentives due to yield-spread premiums was dropped during 2007 from a mortgage-reform bill by the U.S. Congress.[74]

Mortgage underwriting practices have also been criticized, including automated loan approvals that critics argued were not subjected to appropriate review and documentation.[75] In 2007, 40% of all subprime loans resulted from automated underwriting.[76][77] The chairman of the Mortgage Bankers Association claimed that mortgage brokers, while profiting from the home loan boom, did not do enough to examine whether borrowers could repay.[78] Mortgage fraud by borrowers increased. [79]

Securitization practices

[edit]

Securitization, a form of structured finance, involves the pooling of financial assets, especially those for which there is no ready secondary market, such as mortgages, credit card receivables, student loans. The pooled assets are transfered to a special purpose entity and serve as collateral for new financial assets issued by the entity.[80] The diagram at left shows how there are many parties involved.

Securitization, combined with investor appetite for mortgage-backed securities (MBS), and the high ratings formerly granted to MBSs by rating agencies, meant that mortgages with a high risk of default could be sold easily to "warehousers," with the risk shifted from the mortgage originator to investors. Securitization allows issuers to easily generate capital for new loans.

The traditional mortgage model involved a bank originating a loan to the borrower/homeowner and retaining the credit (default) risk. With the advent of securitization, the traditional model has given way to the "originate to distribute" model, in which the credit risk is transferred (distributed) to investors through MBS and CDOs. Securitization created a secondary market for mortgages, and meant that those issuing mortgages were no longer required to hold them to maturity.

Asset securitization began with the creation of private mortgage pools in the 1970s.[81] Securitization accelerated in the mid-1990s. The total amount of mortgage-backed securities issued almost tripled between 1996 and 2007, to $7.3 trillion. The securitized share of subprime mortgages (i.e., those passed to third-party investors via MBS) increased from 54% in 2001, to 75% in 2006.[70] Alan Greenspan has stated that the current global credit crisis cannot be blamed on mortgages being issued to households with poor credit, but rather on the securitization of such mortgages.[82]

American homeowners, consumers, and corporations owed roughly $25 trillion during 2008. American banks retained about $8 trillion of that total directly as traditional mortgage loans. Bondholders and other traditional lenders provided another $7 trillion. The remaining $10 trillion came from the securitization markets. The securitization markets started to close down in the spring of 2007 and nearly shut-down in the fall of 2008. More than a third of the private credit markets thus became unavailable as a source of funds.[83] In February 2009, Ben Bernanke stated that securitization markets remained effectively shut, with the exception of conforming mortgages, which could be sold to Fannie Mae and Freddie Mac.[84]

Securitization involves the transfer of mortgage loans into off-balance sheet entities called structured investment vehicles or special purpose entities. However, the institution effecting the securitization transaction often retains a subordinated interest in the assets, which can concentrate credit risk within the originating institution.[85]

Some believe that mortgage standards became lax because securitization gave rise to a form of moral hazard, whereby each link in the mortgage chain made a profit while passing any associated credit risk to the next link in the chain.[86][87] At the same time, some financial firms retained significant amounts of the MBS they originated, thereby retaining significant amounts of credit risk and so were less guilty of moral hazard. Some argue this was not a flaw in the securitization concept per se, but in its implementation.[27]

A more direct connection between securitization and the subprime crisis relates to a fundamental fault in the way that underwriters, rating agencies and investors modeled the correlation of risks among loans in securitization pools. Correlation modeling--determining how the default risk of one loan in a pool is statistically related to the default risk for other loans--was based on a "Gaussian copula" technique developed by statistician David X. Li. This technique, widely adopted as a means of evaluating the risk associated with securitization transactions, used what turned out to be an overly simplistic approach to correlation. Unfortunately, the flaws in this technique did not become apparent to market participants until after many hundreds of billions of dollars of ABS and CDOs backed by subprime loans had been rated and sold. By the time investors stopped buying subprime-backed securities--which halted the ability of mortgage originators to extend subprime loans--the effects of the crisis were already beginning to emerge.[88]

According to Nobel laureate Dr. A. Michael Spence, "systemic risk escalates in the financial system when formerly uncorrelated risks shift and become highly correlated. When that happens, then insurance and diversification models fail. There are two striking aspects of the current crisis and its origins. One is that systemic risk built steadily in the system. The second is that this buildup went either unnoticed or was not acted upon. That means that it was not perceived by the majority of participants until it was too late. Financial innovation, intended to redistribute and reduce risk, appears mainly to have hidden it from view. An important challenge going forward is to better understand these dynamics as the analytical underpinning of an early warning system with respect to financial instability." [29]

Inaccurate credit ratings

[edit]

Credit rating agencies are now under scrutiny for having given investment-grade ratings to CDOs and MBSs based on subprime mortgage loans. These high ratings were believed justified because of risk reducing practices, including over-collateralization (pledging collateral in excess of debt issued), credit default insurance, and equity investors willing to bear the first losses. However, there are also indications that some involved in rating subprime-related securities knew at the time that the rating process was faulty. Emails exchanged between employees of rating agencies, dated before credit markets deteriorated and put in the public domain by USA Congressional investigators, suggest that some rating agency employees suspected that lax standards for rating structured credit products would result in major problems.[89] For example, one 2006 internal Email from Standard & Poor's stated that "Rating agencies continue to create and [sic] even bigger monster—the CDO market. Let's hope we are all wealthy and retired by the time this house of cards falters."[90]

High ratings encouraged investors to buy securities backed by subprime mortgages, helping finance the housing boom. The reliance on agency ratings and the way ratings were used to justify investments led many investors to treat securitized products — some based on subprime mortgages — as equivalent to higher quality securities. This was exacerbated by the SEC's removal of regulatory barriers and its reduction of disclosure requirements, all in the wake of the Enron scandal.[91]

Critics allege that the rating agencies suffered from conflicts of interest, as they were paid by investment banks and other firms that organize and sell structured securities to investors.[92] On 11 June 2008, the SEC proposed rules designed to mitigate perceived conflicts of interest between rating agencies and issuers of structured securities.[93] On 3 December 2008, the SEC approved measures to strengthen oversight of credit rating agencies, following a ten-month investigation that found "significant weaknesses in ratings practices," including conflicts of interest.[94]

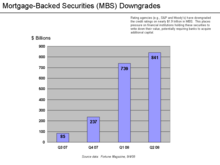

Between Q3 2007 and Q2 2008, rating agencies lowered the credit ratings on $1.9 trillion in mortgage backed securities. Financial institutions felt they had to lower the value of their MBS and acquire additional capital so as to maintain capital ratios. If this involved the sale of new shares of stock, the value of the existing shares was reduced. Thus ratings downgrades lowered the stock prices of many financial firms.[95]

In December 2008 economist Arnold Kling testified at congressional hearings on the collapse of Freddie Mac and Fannie Mae. Kling said that a high-risk loan could be “laundered” by Wall Street and return to the banking system as a highly rated security for sale to investors, obscuring its true risks and avoiding capital reserve requirements.[96]

Government policies

[edit]Both government action and inaction has contributed to the crisis. Some are of the opinion that the current American regulatory framework is outdated. Then President George W. Bush stated in September 2008: "Once this crisis is resolved, there will be time to update our financial regulatory structures. Our 21st century global economy remains regulated largely by outdated 20th century laws."[97] The Securities and Exchange Commission (SEC) has conceded that self-regulation of investment banks contributed to the crisis.[98][99]

Increasing home ownership was a goal of the Clinton and Bush administrations.[100][101][102] There is evidence that the Federal government leaned on the mortgage industry, including Fannie Mae and Freddie Mac (the GSE), to lower lending standards.[103][104][105] Also, the U.S. Department of Housing and Urban Development's (HUD) mortgage policies fueled the trend towards issuing risky loans.[106][107]

In 1995, the GSEs began receiving government incentive payments for purchasing mortgage backed securities which included loans to low income borrowers. Thus began the involvement of the GSE with the subprime market.[106] Subprime mortgage originations rose by 25% per year between 1994 and 2003, resulting in a nearly ten-fold increase in the volume of subprime mortgages in just nine years.[108] The relatively high yields on these securities, in a time of low interest rates, were very attractive to Wall Street, and while Fannie and Freddie generally bought only the least risky subprime mortgages, these purchases encouraged the entire subprime market.[109] In 1996, HUD directed the GSE that at least 42% of the mortgages they purchased should have been issued to borrowers whose household income was below the median in their area. This target was increased to 50% in 2000 and 52% in 2005.[110] From 2002 to 2006 Fannie Mae and Freddie Mac combined purchases of subprime securities rose from $38 billion to around $175 billion per year before dropping to $90 billion, thus fulfilling their government mandate to help make home buying more affordable. During this time, the total market for subprime securities rose from $172 billion to nearly $500 billion only to fall back down to $450 billion. [111]

By 2008, the GSE owned, either directly or through mortgage pools they sponsored, $5.1 trillion in residential mortgages, about half the amount outstanding.[112] The GSE have always been highly leveraged, their net worth as of 30 June 2008 being a mere US$114 billion.[113] When concerns arose in September 2008 regarding the ability of the GSE to make good on their guarantees, the Federal government was forced to place the companies into a conservatorship, effectively nationalizing them at the taxpayers' expense.[3][114]

Liberal economist Robert Kuttner has suggested that the repeal of the Glass-Steagall Act by the Gramm-Leach-Bliley Act of 1999 may have contributed to the subprime meltdown, but this is controversial.[115][116] The Federal government bailout of thrifts during the savings and loan crisis of the late 1980s may have encouraged other lenders to make risky loans, and thus given rise to moral hazard.[117][34]

Economists have also debated the possible effects of the Community Reinvestment Act (CRA), with detractors claiming that the Act encouraged lending to uncreditworthy borrowers,[118][119][120][121] and defenders claiming a thirty year history of lending without increased risk.[122][123][124][125] Detractors also claim that amendments to the CRA in the mid-1990s, raised the amount of mortgages issued to otherwise unqualified low-income borrowers, and allowed the securitization of CRA-regulated mortgages, even though a fair number of them were subprime.[126][127]

Both Federal Reserve Governor Randall Kroszner and FDIC Chairman Sheila Bair have stated their belief that the CRA was not to blame for the crisis.[128]

Policies of central banks

[edit]

Central banks manage monetary policy and may target the rate of inflation. They have some authority over commercial banks and possibly other financial institutions. They are less concerned with avoiding asset price bubbles, such as the housing bubble and dot-com bubble. Central banks have generally chosen to react after such bubbles burst so as to minimize collateral damage to the economy, rather than trying to prevent or stop the bubble itself. This is because identifying an asset bubble and determining the proper monetary policy to deflate it are matters of debate among economists.[130][131]

Some market observers have been concerned that Federal Reserve actions could give rise to moral hazard.[34] A Government Accountability Office critic said that the Federal Reserve Bank of New York's rescue of Long-Term Capital Management in 1998 would encourage large financial institutions to believe that the Federal Reserve would intervene on their behalf if risky loans went sour because they were “too big to fail.”[132]

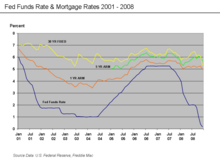

A contributing factor to the rise in house prices was the Federal Reserve's lowering of interest rates early in the decade. From 2000 to 2003, the Federal Reserve lowered the federal funds rate target from 6.5% to 1.0%.[133] This was done to soften the effects of the collapse of the dot-com bubble and of the September 2001 terrorist attacks, and to combat the perceived risk of deflation.[130] The Fed believed that interest rates could be lowered safely primarily because the rate of inflation was low; it disregarded other important factors. Richard W. Fisher, President and CEO of the Federal Reserve Bank of Dallas, said that the Fed's interest rate policy during the early 2000s was misguided, because measured inflation in those years was below true inflation, which led to a monetary policy that contributed to the housing bubble.[134]

The Fed then raised the Fed funds rate significantly between July 2004 and July 2006.[135] This contributed to an increase in 1-year and 5-year ARM rates, making ARM interest rate resets more expensive for homeowners.[136] This may have also contributed to the deflating of the housing bubble, as asset prices generally move inversely to interest rates and it became riskier to speculate in housing.[137][138]

Financial institution debt levels and incentives

[edit]

Many financial institutions, investment banks in particular, issued large amounts of debt during 2004–2007, and invested the proceeds in mortgage-backed securities (MBS), essentially betting that house prices would continue to rise, and that households would continue to make their mortgage payments. Borrowing at a lower interest rate and investing the proceeds at a higher interest rate is a form of financial leverage. This is analogous to an individual taking out a second mortgage on his residence to invest in the stock market. This strategy proved profitable during the housing boom, but resulted in large losses when house prices began to decline and mortgages began to default. Beginning in 2007, financial institutions and individual investors holding MBS also suffered significant losses from mortgage payment defaults and the resulting decline in the value of MBS.[28]

A 2004 SEC ruling allowed USA investment banks to issue substantially more debt, which was then used to purchase MBS. Over 2004-07, the top five US investment banks each significantly increased their financial leverage (see diagram), which increased their vulnerability to the declining value of MBSs. These five institutions reported over $4.1 trillion in debt for fiscal year 2007, about 30% of USA nominal GDP for 2007. Further, the percentage of subprime mortgages originated to total originations increased from below 10% in 2001-2003 to between 18-20% from 2004-2006, due in-part to financing from investment banks.[13][14]

During 2008, three of the largest U.S. investment banks either went bankrupt (Lehman Brothers) or were sold at fire sale prices to other banks (Bear Stearns and Merrill Lynch). These failures augmented the instability in the global financial system. The remaining two investment banks, Morgan Stanley and Goldman Sachs, opted to become commercial banks, thereby subjecting themselves to more stringent regulation.[139]

The New York State Comptroller's Office has said that in 2006, Wall Street executives took home bonuses totaling $23.9 billion. "Wall Street traders were thinking of the bonus at the end of the year, not the long-term health of their firm. The whole system—from mortgage brokers to Wall Street risk managers—seemed tilted toward taking short-term risks while ignoring long-term obligations. The most damning evidence is that most of the people at the top of the banks didn't really understand how those [investments] worked."[38][140]

Investment banker incentive compensation was focused on fees generated from assembling financial products, rather than the performance of those products and profits generated over time. Their bonuses were heavily skewed towards cash rather than stock and not subject to "claw-back" (recovery of the bonus from the employee by the firm) in the event the MBS or CDO created did not perform. In addition, the increased risk (in the form of financial leverage) taken by the major investment banks was not adequately factored into the compensation of senior executives.[141]

Credit default swaps

[edit]Credit defaults swaps (CDS) are financial instruments used as a hedge and protection for debtholders, in particular MBS investors, from the risk of default. As the net worth of banks and other financial institutions deteriorated because of losses related to subprime mortgages, the likelihood increased that those providing the insurance would have to pay their counterparties. This created uncertainty across the system, as investors wondered which companies would be required to pay to cover mortgage defaults.

Like all swaps and other financial derivatives, CDS may either be used to hedge risks (specifically, to insure creditors against default) or to profit from speculation. The volume of CDS outstanding increased 100-fold from 1998 to 2008, with estimates of the debt covered by CDS contracts, as of November 2008, ranging from US$33 to $47 trillion. CDS are lightly regulated. As of 2008, there was no central clearinghouse to honor CDS in the event a party to a CDS proved unable to perform his obligations under the CDS contract. Required disclosure of CDS-related obligations has been criticized as inadequate. Insurance companies such as American International Group (AIG), MBIA, and Ambac faced ratings downgrades because widespread mortgage defaults increased their potential exposure to CDS losses. These firms had to obtain additional funds (capital) to offset this exposure. AIG's having CDSs insuring $440 billion of MBS resulted in its seeking and obtaining a Federal government bailout.[142]

Like all swaps and other pure wagers, what one party loses under a CDS, the other party gains; CDSs merely reallocate existing wealth. Hence the question is which side of the CDS will have to pay and will it be able to do so. When investment bank Lehman Brothers went bankrupt in September 2008, there was much uncertainty as to which financial firms would be required to honor the CDS contracts on its $600 billion of bonds outstanding.[143][144] Merrill Lynch's large losses in 2008 were attributed in part to the drop in value of its unhedged portfolio of collateralized debt obligations (CDOs) after AIG ceased offering CDS on Merrill's CDOs. The loss of confidence of trading partners in Merrill Lynch's solvency and its ability to refinance its short-term debt led to its acquisition by the Bank of America.[145][146]

Economist Joseph Stiglitz summarized how credit default swaps contributed to the systemic meltdown: "With this complicated intertwining of bets of great magnitude, no one could be sure of the financial position of anyone else-or even of one's own position. Not surprisingly, the credit markets froze."[147]

Inflow of funds due to trade deficits

[edit]In 2005, Ben Bernanke addressed the implications of the USA's high and rising current account (trade) deficit, resulting from USA imports exceeding its exports.[148] Between 1996 and 2004, the USA current account deficit increased by $650 billion, from 1.5% to 5.8% of GDP. Financing these deficits required the USA to borrow large sums from abroad, much of it from countries running trade surpluses, mainly the emerging economies in Asia and oil-exporting nations. The balance of payments identity requires that a country (such as the USA) running a current account deficit also have a capital account (investment) surplus of the same amount. Hence large and growing amounts of foreign funds (capital) flowed into the USA to finance its imports. Foreign investors had these funds to lend, either because they had very high personal savings rates (as high as 40% in China), or because of high oil prices. Bernanke referred to this as a "savings glut" that may have pushed capital into the USA, a view differing from that of mainstream economists, who view such capital as having been pulled into the USA by its high consumption levels. In other words, a nation cannot consume more than its income unless it sells assets to foreigners, or foreigners are willing to lend to it.

Regardless of the push or pull view, a "flood" of funds (capital or liquidity) reached the USA financial markets. Foreign governments supplied funds by purchasing USA Treasury bonds and thus avoided much of the direct impact of the crisis. USA households, on the other hand, used funds borrowed from foreigners to finance consumption or to bid up the prices of housing and financial assets. Financial institutions invested foreign funds in mortgage-backed securities. USA housing and financial assets dramatically declined in value after the housing bubble burst.[149][150]

Impact

[edit]Impact in the U.S.

[edit]Between June 2007 and November 2008, Americans lost more than a quarter of their net worth. By early November 2008, a broad U.S. stock index, the S&P 500, was down 45 percent from its 2007 high. Housing prices had dropped 20% from their 2006 peak, with futures markets signaling a 30-35% potential drop. Total home equity in the United States, which was valued at $13 trillion at its peak in 2006, had dropped to $8.8 trillion by mid-2008 and was still falling in late 2008. Total retirement assets, Americans' second-largest household asset, dropped by 22 percent, from $10.3 trillion in 2006 to $8 trillion in mid-2008. During the same period, savings and investment assets (apart from retirement savings) lost $1.2 trillion and pension assets lost $1.3 trillion. Taken together, these losses total a staggering $8.3 trillion.[151]

Financial market impacts, 2007

[edit]

The crisis began to affect the financial sector in February 2007, when HSBC, the world's largest (2008) bank, wrote down its holdings of subprime-related MBS by $10.5 billion, the first major subprime related loss to be reported.[152] During 2007, at least 100 mortgage companies either shut down, suspended operations or were sold.[153] Top management has not escaped unscathed, as the CEOs of Merrill Lynch and Citigroup resigned within a week of each other in late 2007.[154] As the crisis deepened, more and more financial firms either merged, or announced that they were negotiating seeking merger partners.[155]

During 2007, the crisis caused panic in financial markets and encouraged investors to take their money out of risky mortgage bonds and shaky equities and put it into commodities as "stores of value".[156] Financial speculation in commodity futures following the collapse of the financial derivatives markets has contributed to the world food price crisis and oil price increases due to a "commodities super-cycle."[157][158] Financial speculators seeking quick returns have removed trillions of dollars from equities and mortgage bonds, some of which has been invested into food and raw materials.[159]

Mortgage defaults and provisions for future defaults caused profits at the 8533 USA depository institutions insured by the FDIC to decline from $35.2 billion in 2006 Q4 billion to $646 million in the same quarter a year later, a decline of 98%. 2007 Q4 saw the worst bank and thrift quarterly performance since 1990. In all of 2007, insured depository institutions earned approximately $100 billion, down 31% from a record profit of $145 billion in 2006. Profits declined from $35.6 billion in 2007 Q1 to $19.3 billion in 2008 Q1, a decline of 46%.[160][161]

Financial market impacts, 2008

[edit]

As of August 2008, financial firms around the globe have written down their holdings of subprime related securities by US$501 billion.[162] The IMF estimates that financial institutions around the globe will eventually have to write off $1.5 trillion of their holdings of subprime MBSs. About $750 billion in such losses had been recognized as of November 2008. These losses have wiped out much of the capital of the world banking system. Banks headquartered in nations that have signed the Basel Accords must have so many cents of capital for every dollar of credit extended to consumers and businesses. Thus the massive reduction in bank capital just described has reduced the credit available to businesses and households.[163]

When Lehman Brothers and other important financial institutions failed in September 2008, the crisis hit a key point.[164] During a two day period in September 2008, $150 billion were withdrawn from USA money funds. The average two day outflow had been $5 billion. In effect, the money market was subject to a bank run. The money market had been a key source of credit for banks (CDs) and nonfinancial firms (commercial paper). The TED spread (see graph above), a measure of the risk of interbank lending, quadrupled shortly after the Lehman failure. This credit freeze brought the global financial system to the brink of collapse. The response of the USA Federal Reserve, the European Central Bank, and other central banks was immediate and dramatic. During the last quarter of 2008, these central banks purchased US$2.5 trillion of government debt and troubled private assets from banks. This was the largest liquidity injection into the credit market, and the largest monetary policy action, in world history. The governments of European nations and the USA also raised the capital of their national banking systems by $1.5 trillion, by purchasing newly issued preferred stock in their major banks. [163]

However, some economists state that Third-World economies, such as the Brazilian and Chinese ones, will not suffer as much as those from more developed countries.[165]

Securitization market impact

[edit]

Before the crisis, banks would lend to customers for mortgages, credit cards or auto loans, then sell the related assets to investors via the securitization markets. The allowed banks to replenish their cash so they could lend again, generating fees with each transaction. The securitization markets started to close down in the spring of 2007 and nearly shut-down in the fall of 2008. More than a third of the private credit markets thus became unavailable as a source of funds.[166] In February 2009, Ben Bernanke stated that securitization markets remained effectively shut, with the exception of conforming mortgages, which could be sold to Fannie Mae and Freddie Mac.[167]

Economist Richard Katz described the effect this way in March 2009: "This run on the shadow banking system is the real cause of the severe post-September credit crunch that transformed a mild recession into something far worse. Banks have actually increased their extension of credit by six percent since September, but they are having a hard time securitizing those loans in the capital markets. That means that they can no longer use the proceeds to make further loans, which would allow them to use the initial dollar over and over again." Katz stated that securitization markets closed due to a combination of fear, derivatives, and accounting rules, using an example: "...by mid-December 2008, pure panic had pushed the value of AAA-rated commercial-mortgage-backed securities (CMBS) down to 68 percent of their face value, despite a commercial-mortgage delinquency rate of only one percent. That 32 percent loss has reverberated throughout the financial system due to mark-to-market accounting rules, which require securities to be valued at their current market price, even in markets where there is little trading and prices fluctuate wildly. As a result of these rules, all investors holding CMBS have had to write down their holdings by 32 percent, even if the underlying mortgages are being paid on time. That, in turn, has led prices to decline even more and investors to write off more capital, further tightening the credit crunch."[168]

Indirect economic effects

[edit]The subprime crisis has had a number of adverse effects on the overall American economic situation. U.S. GDP contracted at a 6.2% annual rate during Q4 2008.[169] In the 12 month period ending in february 2009, the number of unemployed persons in the U.S. increased by approximately five million.[170] There have been significant job losses in the financial sector, with over 65,400 jobs lost in the USA as of September 2008.[171] The U.S. unemployment rate climbed to 8.1% in February 2009, the highest level in 26 years.[172]

Declining house prices have reduced household wealth and the collateral for home equity loans, which is placing downward pressure on consumption.[173] The tightening of credit has caused a major decline in the sale of motor vehicles. Between October 2007 and October 2008, Ford sales were down 33.8%, General Motors sales were down 15.6%, and Toyota sales had declined 32.3%.[174] There is an ongoing global automobile industry crisis, and calls for some form of government intervention.

Members of USA minority groups received a disproportionate number of subprime mortgages, and so have experienced a disproportionate level of the resulting foreclosures. Minorities have also born the brunt of the dramatic reduction in subprime lending.[175][176] House-related crimes such as arson have increased.[177] Many renters became innocent victims, by being evicted from their residences without notice, because their landlords' property has been foreclosed.[178] In October 2008, Tom Dart, the elected Sheriff of Cook County, Illinois, criticized mortgage lenders for the adverse consequences their actions had on tenants, and announced that he was suspending all foreclosure evictions.[179]

Nationwide, up to 40% of all people at risk of eviction due to foreclosure are renters, according to the National Low Income Housing Coalition. In most cases, lenders insist on evicting all tenants even though vacant buildings often become targets for vandals.[180]

Responses

[edit]Various actions have been taken since the crisis became apparent in August 2007. In September 2008, major instability in world financial markets increased awareness and attention to the crisis. Various agencies and regulators, as well as political officials, began to take additional, more comprehensive steps to handle the crisis.

To date, various government agencies have committed or spent trillions of dollars in loans, asset purchases, guarentees, and direct spending. For a summary of U.S. government financial commitments and investments related to the crisis, see CNN - Bailout Scorecard.

Federal Reserve and central banks

[edit]The central bank of the USA, the Federal Reserve, in partnership with central banks around the world, has taken several steps to address the crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008: "Broadly, the Federal Reserve's response has followed two tracks: efforts to support market liquidity and functioning and the pursuit of our macroeconomic objectives through monetary policy."[17] The Fed has:

- Lowered the target for the Federal funds rate from 5.25% to 2%, and the discount rate from 5.75% to 2.25%. This took place in six steps occurring between 18 September 2007 and 30 April 2008;[181][182]

- Undertaken, along with other central banks, open market operations to ensure member banks remain liquid. These are effectively short-term loans to member banks collateralized by government securities. Central banks have also lowered the interest rates (called the discount rate in the USA) they charge member banks for short-term loans;[183]

- Used the Term Auction Facility (TAF) to provide short-term loans (liquidity) to banks. The Fed increased the monthly amount of these auctions throughout the crisis, raising it to $300 billion by November 2008, up from $20 billion at inception. A total of $1.6 trillion in loans to banks were made for various types of collateral by November 2008.[184]

- Finalized, in July 2008, new rules for mortgage lenders;[185]

- In October 2008, the Fed expanded the collateral it will lend against to include commercial paper, to help address continued liquidity concerns.[186] By November 2008, the Fed had purchased $271 billion of such paper, out of a program limit of $1.4 trillion.[184]

- In November 2008, the Fed announced the $200 billion Term Asset-Backed Securities Loan Facility (TALF). This program supported the issuance of asset-backed securities (ABS) collateralized by loans related to autos, credit cards, education, and small businesses. This step was taken to offset liquidity concerns.[187]

- In November 2008, the Fed announced a $600 billion program to purchase the MBS of the GSE, to help lower mortgage rates.[188]

Regulation

[edit]Regulators and legislators have contemplated taking action with respect to lending practices, bankruptcy protection, tax policies, affordable housing, credit counseling, education, and the licensing and qualifications of lenders.[189] Regulations or guidelines can influence the transparency and reporting required of lenders and the types of loans they choose to issue. Congressional committees are also conducting hearings to help identify solutions and apply pressure to the various parties involved.[190]

- On 31 March 2008, a sweeping expansion of the Fed's regulatory powers was proposed, that would expand its jurisdiction over nonbank financial institutions, and its authority to intervene in market crises.[191]

- Responding to concerns that lending was not properly regulated, the House and Senate are both considering bills to further regulate lending practices.[192]

- Countrywide Financial's VIP program has led ethics experts and key senators to recommend that members of Congress be required to disclose information about the mortgages they take out.[193]

- Nondepository banks (e.g., investment banks and mortgage companies) are not subject to the same capital requirements as depository banks. Many investment banks had limited capital to offset declines in their holdings of MBSs, or to support their side of credit default insurance contracts. Fed Chairman Ben Bernanke stated there is a need for "well-defined procedures and authorities for dealing with the potential failure of a systemically important non-bank financial institution."[194]

- Nobel prize winner Joseph Stiglitz has recommended that the USA adopt regulations restricting leverage, and preventing companies from becoming "too big to fail."[195]

- British Prime Minister Gordon Brown and Nobel laureate A. Michael Spence have argued for an "early warning system" to help detect a confluence of events leading to systemic risk.[196] Dr. Ram Charan has also argued for risk management early warning systems at the corporate board level.[197]

- On 18 September 2008, UK regulators announced a temporary ban on short-selling the stock of financial firms.[198]

- The Australian government will invest AU$4 billion in mortgage backed securities issued by nonbank lenders, in an attempt to maintain competition in the mortgage market. However this is considered a drop in the ocean in regards to total lending.[199]

- Alan Greenspan has called for banks to have a 14% capital ratio, rather than the historical 8-10%. Major U.S. banks had capital ratios of around 12% in December 2008 after the initial round of bailout funds. The minimum capital ratio is regulated.[200]

- Economists Nouriel Roubini and Lasse Pederson recommended in January 2009 that capital requirements for financial institutions be proportional to the systemic risk they pose, based on an assessment by regulators. Further, each financial institution would pay an insurance premium to the government based on its systemic risk.[201]

- Former President Bill Clinton and former Federal Reserve Chairman Alan Greenspan indicated they did not properly regulate derivatives, including credit default swaps.[202][203]A bill (the Derivatives Markets Transparency and Accountability Act of 2009 (H.R. 977) has been proposed to further regulate the CDS market and establish a clearinghouse. This bill would provide the authority to suspend CDS trading under certain conditions.[204]

- Warren Buffett stated in February 2009: "The present housing debacle should teach home buyers, lenders, brokers and government some simple lessons that will ensure stability in the future. Home purchases should involve an honest-to-God down payment of at least 10 percent and monthly payments that can be comfortably handled by the borrower's income. That income should be carefully verified."[205]

Economic stimulus

[edit]en:Template:Main en:Template:Main

On 13 February 2008, President Bush signed into law a $168 billion economic stimulus package, mainly taking the form of income tax rebate checks mailed directly to taxpayers.[206] Checks were mailed starting the week of 28 April 2008. However, this rebate coincided with an unexpected jump in gasoline and food prices. This coincidence led some to wonder whether the stimulus package would have the intended effect, or whether consumers would simply spend their rebates to cover higher food and fuel prices.

On 17 February 2009, U.S. President Barack Obama signed the American Recovery and Reinvestment Act of 2009, an $800 billion stimulus package with a broad spectrum of spending and tax cuts.[207]

Government bailouts and failures of financial firms

[edit]

- Northern Rock, encountering difficulty obtaining the credit it required to remain in business, was nationalized on 17 February 2008. As of 8 October 8 2008, United Kingdom taxpayer liability arising from this takeover had risen to £87 billion ($150 billion).[208]

- Bear Stearns was acquired by J.P. Morgan Chase in March 2008 for $1.2 billion.[209] The sale was conditional on the Fed's lending Bear Sterns US$29 billion on a nonrecourse basis.[210]

- IndyMac Bank, America's leading Alt-A originator in 2006[211] with approximately $32 billion in deposits was placed into conservatorship by the FDIC on July 11, 2008, citing liquidity concerns. A bridge bank, IndyMac Federal Bank, FSB, was established under the control of the FDIC.[212]

- The GSEs Fannie Mae and Freddie Mac were both placed in conservatorship in September 2008.[213] The two GSE's guarantee or hold mortgage backed securities(MBS), mortgages and other debt with a Notional value of more than $5 trillion.[214]

- Merrill Lynch was acquired by Bank of America in September 2008 for $50 billion.[215]

- Scottish banking group HBOS agreed on 17 September 2008 to an emergency acquisition by its UK rival Lloyds TSB, after a major decline in HBOS's share price stemming from growing fears about its exposure to British and American MBSs. The UK government made this takeover possible by agreeing to waive its competition rules.[216]

- Lehman Brothers declared bankruptcy on 15 September 2008, after the Secretary of the Treasury Henry Paulson, citing moral hazard, refused to bail it out.[217][218]

- AIG received an $85 billion emergency loan in September 2008 from the Federal Reserve.[219] which AIG is expected to repay by gradually selling off its assets.[220] In exchange, the Federal government acquired a 79.9% equity stake in AIG.[220] AIG may eventually cost U.S. taxpayers nearly $250 billion, due to its critical position insuring the toxic assets of many large international financial institutions through credit default swaps.[221]

- Washington Mutual (WaMu) was seized in September 2008 by the USA Office of Thrift Supervision (OTS).[222] Most of WaMu's untroubled assets were to be sold to J.P. Morgan Chase.[223]

- British bank Bradford & Bingley was nationalised on 29 September 2008 by the UK government. The government assumed control of the bank's £50 billion mortgage and loan portfolio, while its deposit and branch network are to be sold to Spain's Grupo Santander.[224]

- In October 2008, the Australian government announced that it would make AU$4 billion available to nonbank lenders unable to issue new loans. After discussion with the industry, this amount was increased to AU$8 billion.[225]

- In November 2008, the U.S. government announced it was purchasing $27 billion of preferred stock in Citigroup, a USA bank with over $2 trillion in assets, and warrants on 4.5% of its common stock. The preferred stock carries an 8% dividend. This purchase follows an earlier purchase of $25 billion of the same preferred stock using TARP funds. [226]

Bank capital replenishment

[edit]Summary

[edit]Losses on mortgage-backed securities and other assets purchased with borrowed money have dramatically reduced the capital base of financial institutions, rendering many either insolvent or less capable of lending. Banks have taken significant steps to acquire additional capital from private sources and governments have also injected capital into selected banks.

Emergency Economic Stabilization Act of 2008 / EESA or TARP

[edit]The EESA was signed into law by President Bush on October 3, 2008. This law included $700 billion in funding for the "Troubled Assets Relief Program" or TARP, which was initially intended to purchase from financial institutions large amounts of mortgage backed securities (MBSs) and collateralized debt obligations (CDOs) backed by subprime mortgages, also known as "toxic assets."[227][228] The plan also banned short-selling the stocks of financial firms.[229]

After the law was passed, the U.S. Treasury instead primarily used the first $350 billion of bailout funds to inject funds into banks in exchange for dividend-paying, non-voting preferred stock. This avoided the complex issue of how much to pay for the toxic assets and how to manage them once under government ownership.[230]

A Congressional Oversight Panel (COP) chaired by Harvard Professor Elizabeth Warren was created to monitor the implementation of the law. COP issued its first report on 10 December 2008, which was primarily a series of questions and answers.[231][232] In an interview, Warren stated that banks cannot be stabilized unless foreclosures are addressed.[233]

For a summary of U.S. government financial commitments and investments related to the crisis, see CNN - Bailout Scorecard.

For a summary of TARP funds provided to U.S. banks as of December 2008, see Reuters-TARP Funds.

Bank capital replenishment from private sources

[edit]As of May 2008, major financial institutions had obtained over $260 billion in new capital, taking the form of bonds or preferred stock sold to private investors in exchange for cash.[234] This new capital has helped banks maintain required capital ratios (an important measure of financial health), which have declined significantly due to losses on subprime loans or CDO investments. Raising additional capital has been advocated by the leadership of the U.S. Federal Reserve and the Treasury Department.[235] Well-capitalized banks are in a better position to lend at favorable interest rates, and to offset the falling liquidity and rising uncertainty in credit markets. Banks have obtained some of their new capital from the sovereign wealth funds of developing countries, which may have political implications.[236]

Certain major banks have also reduced their dividend payouts to stabilize their financial position.[237] Of the 3776 FDIC insured institutions that paid a dividend on their common stock in the first quarter of 2007, almost half (48%) paid a lower dividend in the first quarter of 2008, and 666 institutions reduced their dividend to zero. Insured institutions paid $14.0 billion in total dividends in the first quarter of 2008, down $12.2 billion (46.5%) from the first quarter of 2007.[238]

Steven Pearlstein has advocated government guarantees for new preferred stock, to encourage investors to provide private capital to the banks.[239]

Homeowner assistance

[edit]Summary

[edit]A variety of voluntary private and government-administered or supported programs were implemented during 2007-2009 to assist homeowners with case-by-case mortgage assistance, to mitigate the foreclosure crisis engulfing the U.S. There are four primary variables that can be adjusted to lower monthly payments and help homeowners: 1) Reduce the interest rate; 2) Reduce the loan principal amount; 3) Extend the mortgage term, such as from 30 to 40 years; and 4) Convert variable-rate ARM mortgages to fixed-rate.

Critics have argued that the case-by-case loan modification method is ineffective, with too few homeowners assisted relative to the number of foreclosures and with nearly 40% of those assisted homeowners again becoming delinquent within 8 months.[240]

On 18 February 2009, economists Nouriel Roubini and Mark Zandi recommended an "across the board" (systemic) reduction of mortgage principal balances by as much as 20-30%. Lowering the mortgage balance would help lower monthly payments and also address an estimated 20 million homeowners that may have a financial incentive to enter voluntary foreclosure because they are "underwater" (i.e., the mortgage balance is larger than the home value).[241][242]

Lending industry action

[edit]Both lenders and borrowers may benefit from avoiding foreclosure, which is a costly and lengthy process. Some lenders have offered troubled borrowers more favorable mortgage terms (i.e., refinancing, loan modification or loss mitigation). Borrowers have also been encouraged to contact their lenders to discuss alternatives.[243]

Corporations, trade groups, and consumer advocates have begun to cite data on the numbers and types of borrowers assisted by loan modification programs. There is some disagreement regarding the data, and the adequacy of measures taken to date. A report January 2008 report stated that mortgage lenders modified 54,000 loans and established 183,000 repayment plans in the third quarter of 2007, a period in which there were 384,000 foreclosures were initiated. Consumer groups claimed these modifications affected less than 1% of the 3 million ARM subprime mortgages outstanding as of the third quarter.[244]

The State Foreclosure Prevention Working Group, a coalition of state attorney generals and bank regulators from 11 states, reported in April 2008 that loan servicers could not keep up with the rising number of foreclosures. 70% of subprime mortgage holders are not getting the help they need. Nearly two-thirds of loan workouts require more than six weeks to complete under the current "case-by-case" method of review. In order to slow the growth of foreclosures, the Group has recommended a more automated method of loan modification that can be applied to large blocks of struggling borrowers.[245]

In December 2008, the U.S. FDIC reported that more than half of mortgages modified during the first half of 2008 were delinquent again, in many cases because payments were not reduced or mortgage debt was not forgiven. This is further evidence that case-by-case loan modification is not effective as a policy tool.[246]

On October 5, 2008, the Bank of America, following on a legal settlement with several states, announced a more aggressive and systematic program intended to help an estimated 400,000 borrowers keep their homes. The program will limit payments as a fraction of household income, and reduce mortgage balances.[247]

In November 2008, Fannie Mae, Freddie Mac and their network of mortgage service providers announced a streamlined loan modification program and foreclosure suspension, designed to help keep borrowers in their homes.[248][249]

Several Australian lenders have amended their policies for higher risk mortgage types. These changes have been relatively minor, with the exception of those nonconforming lenders that lend to credit impaired and subprime borrowers. It remains to be seen if this trend will continue, or if Australian lenders will eventually stop offering riskier loan products.[250]

Hope Now Alliance

[edit]Former President George W. Bush announced a plan to voluntarily and temporarily freeze the mortgages of a limited number of mortgage debtors holding ARMs.[251][252] A refinancing facility called FHA-Secure was also created.[253] These actions are part of the Hope Now Alliance, an ongoing collaborative effort between the US Government and private industry to help certain subprime borrowers.[254] In February 2008, the Alliance reported that during the second half of 2007, it had helped 545,000 subprime borrowers with shaky credit, or 7.7% of 7.1 million subprime loans outstanding as of September 2007. A spokesperson for the Alliance acknowledged that much more must be done.[255]

During February 2008, a program called "Project Lifeline" was announced. Six of the largest USA lenders, in partnership with the Hope Now Alliance, agreed to defer foreclosure actions for 30 days for borrowers 90 or more days delinquent on their mortgage payments. The intent of the program was to reduce foreclosures by encouraging loan adjustments.[256]

Housing and Economic Recovery Act of 2008

[edit]The Housing and Economic Recovery Act of 2008 was signed into law on July 30, 2008 and included six separate major acts intended to restore confidence in the American mortgage industry.[257] The Act:

- Insures $300 billion in mortgages, that will assist an estimated 400,000 borrowers;

- Creates a new Federal regulator to ensure the safe and sound operation of the GSEs (Fannie Mae and Freddie Mac) and Federal Home Loan Banks;

- Raises the ceiling on the dollar value of the mortgages the government sponsored enterprises (GSEs) may purchase;

- Lends money to mortgage bankers to help them refinance the mortgages of owner-occupants at risk of foreclosure. The lender reduces the amount of the mortgage (typically taking a significant loss), in exchange for sharing in any future appreciation in the selling price of the house via the Federal Housing Administration. The refinancing must have fixed payments for a term of 30 years;

- Requires that lenders disclose more information about the products they offer and the deals they close;

- Helps local governments buy and renovate foreclosed properties.

Critics have indicated this law was wholly ineffective, with fewer than 1,000 homeowners helped, due to a requirement that lenders voluntarily write down the mortgage principal amount.[240]

President Obama's mortgage plan (Homeowners Affordability and Stability Plan)

[edit]en:Template:Main On 18 February 2009, U.S. President Barack Obama announced a $75 billion program to help up to nine million homeowners avoid foreclosure, which was supplemented by $200 billion in additional funding for Fannie Mae and Freddie Mac to purchase and more easily refinance mortgages. The plan is funded mostly from the EESA's $700 billion financial bailout fund. It uses cost sharing and incentives to encourage lenders to reduce homeowner's monthly payments to 31 percent of their monthly income. Under the program, a lender would be responsible for reducing monthly payments to no more than 38 percent of a borrower’s income, with government sharing the cost to further cut the rate to 31 percent. The plan also involves forgiving a portion of the borrower’s mortgage balance. Companies that service mortgages will get incentives to modify loans and to help the homeowner stay current.[258][259][260]

Litigation

[edit]Litigation related to the subprime crisis is underway. A study released in February 2008 indicated that 278 civil lawsuits were filed in federal courts during 2007 related to the subprime crisis. The number of filings in state courts was not quantified but is also believed to be significant. The study found that 43% of the cases were class actions brought by borrowers, such as those that contended they were victims of discriminatory lending practices. Other cases include securities lawsuits filed by investors, commercial contract disputes, employment class actions, and bankruptcy-related cases. Defendants included mortgage bankers, brokers, lenders, appraisers, title companies, home builders, servicers, issuers, underwriters, bond insurers, money managers, public accounting firms, and company boards and officers.[261] Former Bear Stearns managers were named in civil lawsuits brought in 2007 by investors, including Barclays Bank PLC, who claimed they had been misled.[262]

An important issue related to the restructuring of mortgage loans involves the contractual rights of investors who purchased related MBS. Investor permission is often required to modify the underlying mortgages, resulting in a "case-by-case" loan modification regime. This presents a challenge for banks and governments who are attempting to limit foreclosures by helping large groups of homeowners re-negotiate the terms of their mortgages efficiently. A class-action lawsuit was filed in December 2008 that may have significant implications.[263]

Law enforcement

[edit]The number of Federal Bureau of Investigation (FBI) agents assigned to mortgage-related crimes increased by 50% between 2007 and 2008.[264] In June 2008, the FBI stated that its mortgage fraud caseload has doubled in the past three years to more than 1,400 pending cases.[265] Between 1 March and 18 June 2008, 406 people were arrested for mortgage fraud in an FBI sting across the country. People arrested include buyers, sellers and others across the wide-ranging mortgage industry.[264]

On 8 March 2008, the FBI began a probe of Countrywide Financial for possible fraudulent lending practices, securities fraud.[266]

On 19 June 2008, two former Bear Stearns managers were arrested by the FBI, and were the first Wall Street executives arrested related to the subprime lending crisis. They were suspected of misleading investors about the risky subprime mortgage market.[262]

On July 16, 2008, an unnamed US Government official said that the FBI is investigating IndyMac for possible fraud. It is not clear if the investigation began before the bank was taken over by the FDIC upon its $32 billion collapse. [267][268]

On 23 September 2008, in response to concerns about the bailouts of so many firms, two government officials stated that the Federal Bureau of Investigation was looking into the possibility of fraud by mortgage financing companies Fannie Mae and Freddie Mac, Lehman Brothers, and insurer American International Group, bringing to 26 the number of corporate lenders under investigation.[269]

Ethics investigation

[edit]On 18 June 2008, a Congressional ethics panel started examining allegations that Democrat Senators Christopher Dodd of Connecticut (the sponsor of a major $300 billion housing rescue bill) and Kent Conrad of North Dakota received preferential loans by troubled mortgage lender Countrywide Financial Corp.[270]

Executive compensation reform